Are you looking to develop a killer trading strategy to propel you to success? Trading can be incredibly lucrative, provided you have the right plan in place and know how to implement it. After all, a winning strategy requires discipline and mastery; otherwise, your efforts will likely fall short of their desired outcomes. That’s why we’re discussing five strategies traders use to create successful trading performances today.

From technical analysis techniques like support and resistance levels, trendlines, exponential moving averages (EMA), relative strength index (RSI) oscillators, and more, each method offers insight into price factors affecting the market that can help inform intelligent decision-making so people can make lucrative trades. Read on if you’re interested in developing or honing the skills necessary for financial freedom through successful investing.

Identify Your Trading Goals

Before you begin trading, developing a clear plan for your investment objectives is essential. Experts such as Saxo Bank recommend that traders define their goals in terms of the type of strategies they wish to employ, the asset classes they are interested in investing in, and how much risk they are willing to take on. Once you’ve answered these questions, you’ll better understand the risk-return ratios that work best for your circumstances.

Trading goals are crucial for setting yourself up for success. If you don’t start with a clear idea of the path that you want to take, it’s doubtful that you’ll be able to capitalize on any opportunities or maximize market conditions for you to do well.

Set Realistic Expectations

It’s common for traders to overestimate their ability to achieve success in the market. Unfortunately, this is a sure-fire way to set yourself up for failure. A good rule of thumb is to understand that developing advantageous trading strategies requires time and practice. There are no shortcuts or quick fixes – it takes dedicated effort, research, and testing before you can expect a better grasp of the markets.

It’s also important to understand that trading never has any guarantees, so there’s always risk involved. That’s why it’s wise to manage your expectations by setting realistic benchmarks and working towards well-defined goals. Additionally, it’s a good idea to set up a trading plan that outlines the steps you’ll take whenever you enter and exit trades.

Use Trading Tools For Analysis

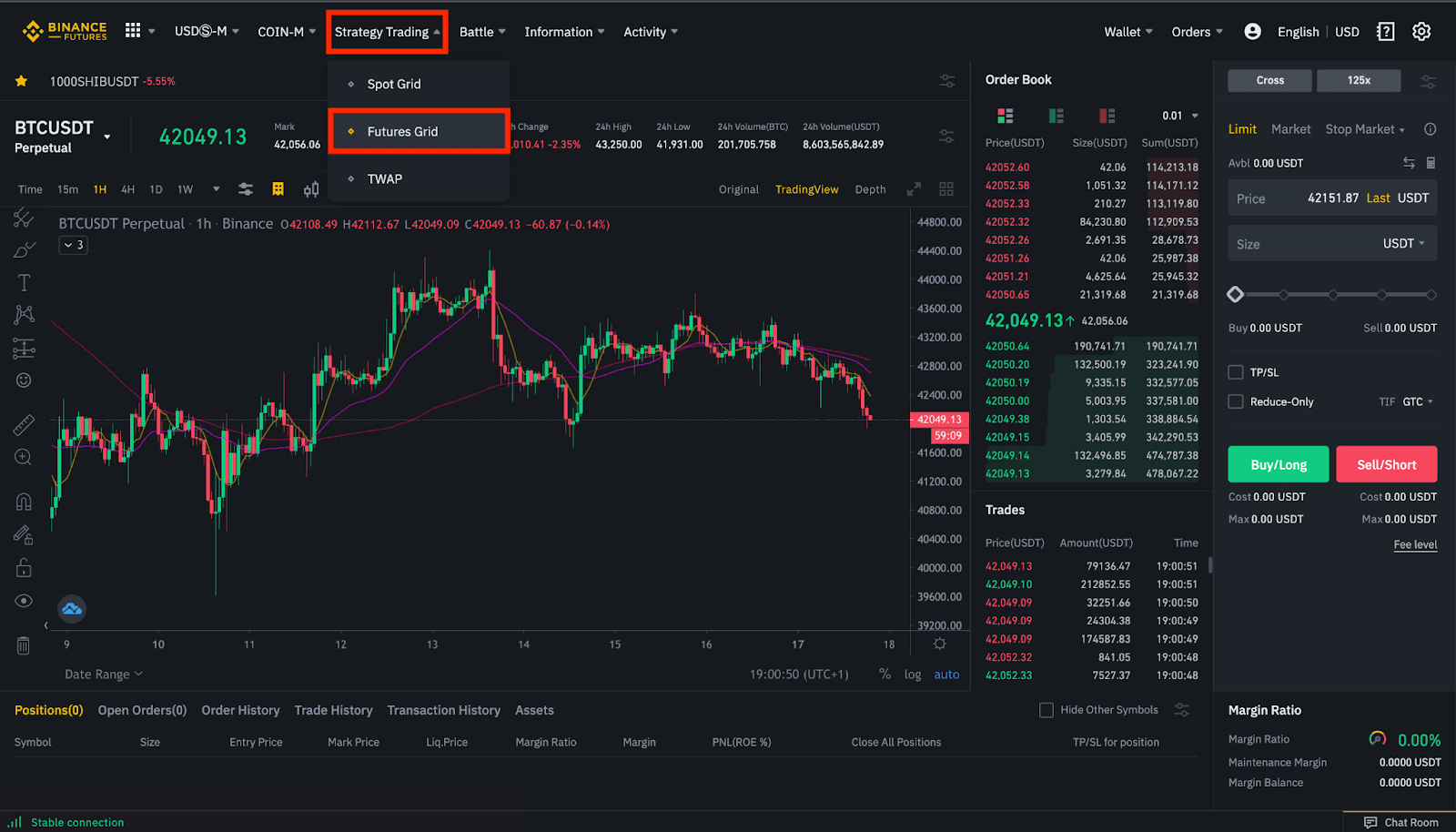

Successful trading isn’t a guessing game; it requires an in-depth understanding of market conditions and the ability to analyze data effectively. That’s why it’s essential to use tools that provide insights into price movements and help you identify entry/exit signals for potential trades.

Technical analysis is one of the most popular methods for forecasting price movements, and it relies on charts and indicators to interpret past performance and predict future trends. Popular technical analysis tools include support and resistance levels, trendlines, EMA, RSI oscillators, moving averages, etc.

These methods can help you determine when to buy or sell based on calculated measures of market momentum. Some platforms also offer automation tools to help you make decisions faster and more accurately.

Monitor The Markets Regularly

Successful trading strategies require constant monitoring of market conditions. Informed decision-making is one of the keys to consistent profits, so keeping track of news and events that could affect prices is essential.

It’s also a good idea to use alerts and notifications that can help you stay up-to-date with the markets. This way, you’ll be able to react quickly and efficiently should a market shift occur. Additionally, monitoring the markets can help you identify potentially profitable trade opportunities.

Utilize Risk Management Strategies

Creating a winning trading strategy requires more than just technical analysis and market monitoring. Employing risk management strategies to protect your capital from potential losses is also essential.

Some popular risk management methods include setting stop-loss orders, diversifying investments across different asset classes, and limiting leverage exposure. Additionally, it’s also important to stay disciplined and stick to your trading plan, which will help you minimize losses and increase the chances of success in the long run.

By employing these strategies, you can ensure that you’re always taking calculated risks tailored to your individual needs. Doing so will maximize your chances of making consistent profits while limiting potential losses.

Conclusion

Creating a winning trading strategy can be challenging, but it can succeed with the right combination of market analysis, risk management techniques, and discipline. These five tips can set you on the path toward performing well when trading. With time and practice, you’ll be well on your way to building a successful trading strategy that works for you. Research and never risk more than you can afford to lose.